Maharashtra charges the highest tax on petrol of Rs 31 per litre through VAT of 26% and a fixed charge of Rs 10.12 per liter. it's neighbor Gujarat only charges Rs 12.4 per litre through VAT of 13.7% and cess on the VAT of Rs 4%. Thus Maharashtra state tax per litre is 2.5 times that of Gujarat. Also the Rs 111.6 per litre that citizens of Maharashtra pay is because the state now charges above 30% more tax than the central.

Following the cut in Excise duties on Petrol & Diesel by the center, a lot of claims have originated from states. But let's separate facts from fiction.

First let us correct the misconception that some states have actually cut their taxes in the last few days. For instance a news report on may 23 stated; "Kerala's LDF Government reduce taxes by Rs 2.41 and Rs 1.36 per litre on petrol and diesel, respectively. The Congress - led Rajasthan government cut VAT on petrol by Rs 2.48 per litre and diesel by Rs 1.16 per litre. While the Shiv Sena - led Maharashtra Government cut VAT by Rs. 2.08 per litre on petrol and Rs 1.44 per litre on diesel." Operative words in the report are "reduced"and "cut" however the perception these operative words create is incorrect.

Decrease in VAT in these states are an inevitable out of the center's cuts in excise duty. As petrol and diesel are not included in the GST, the consumer pays state taxes even on the central tax. In fact, the key reason for instituting the GST was to avoid this tax on tax the consumer used to pay.

As VAT rates in Kerala, Rajasthan and Maharashtra are 30.08%, 31% and 26% respectively, and since the centre cut petrol excise duty by Rs 8, we can calculate the following; Rs 8 × 30.08% equals Rs 2.41, Rs 8 × 31% equals Rs 2.48 and Rs 8 × 26% equals Rs 2.08 - exactly the amount media reports say these state's petrol taxes were reduced by.

So, these reduction willy-nilly stem from the central excise duty cut and are applicable to every state based on their respective VAT rates. Citizens in Kerala, Rajasthan and Maharashtra must recognize that their state governments are touting a move their governments had no role in, unlike 25 other states that resisted such a temptation.

A second Misperception being created by state government is; "The burden on the consumer is primarily due to central taxes."Again, the data separates this fiction from facts.

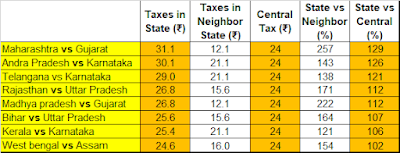

As Shown clearly in Graphic, taxes charged by states contribute significantly to the final price at the petrol pump. 8 states - Maharashtra, Madya Pradesh, Andhra Pradesh, Telangana, Kerala, Bangal Rajasthan and West Bengal charge the most state taxes on petrol, thereby causing the highest prices for petrol in these states. We focus on these states now.

Take Maharashtra, which charges the highest tax on petrol of Rs 31 per litre through VAT of 26% and a fixed charge of Rs 10.12 per litre. It's neighbor Gujarat only charges Rs 12.4 per litre through VAT of 13.7% and cess on the VAT of 4%. Thus Maharashtra State tax per litre is 2.5 times that of Gujarat.

Also the central tax, which is calculated as the difference between the pre VAT price and the price charged by the dealer, is Rs 24 as on may 24 therefore the highest price of Rs 111.6 per litre that citizen of Maharashtra pay is because the state government now charges above 30% more tax than the Ce0ntre.

By removing the fixed charge of 10.12 per litre and reducing the VAT rate to that in Gujarat, Maharashtra can reduce the retail price of petrol to Rs 92.9 per litre. Similarity other outlier states can reduce the price of petrol in their state by at least Rs 10 and provide relief to the consumer.

As for the fiscal impact, recognize that every state and centre must be careful about their budget, so pressure is not selectively felt by these outlier states. Given the current level of inflation, these outlier state must take responsibility to reduce fuel price in their states.

See Graphic for comparisons between high taxing states and taxes in their neighbors and comparisons between central and outlier states taxes.

All southern states charge high petrol taxes. While Karnataka charges the least among southern states at Rs 21.1 per litre, this amount is significantly greater than that charged by Meghalaya, Rs 11.4, and Gujarat, Arunachal Pradesh and Puduchery of Rs 12. Even Compared to Karnataka. Andhra Pradesh, Telangana and Kerala Charge considerably more tax on petrol.

Finally these outlier states charges at least as much tax now as the Centre. In contrast, Meghalaya, Mizoram, Puduchery, Uttar Pradesh, Uttara Khand, Punjab and Tripura charge significantly lower state taxes on petrol than the Centre.

In sum, outlier States can't shirk their responsibility in fighting inflation. As their excuses are clearly not borne out in the data, these outlier states must follow the Central tax cut of Rs 13 on petrol - this includes the 2021 pre-Diwali cut- with at least Rs 10 cut in their VAT.